The Sandwater approach

At Sandwater, we don’t just invest in companies — we commit to their journey

Venture capital investments in resource efficiency, energy transition, productivity and resilience is our sweet spot. We leverage our expertise to support both software- and hardware-driven companies to scale the solutions of tomorrow. We look for vast opportunities that solve critical issues in large, global markets. Our team spends considerable time with our portfolio teams, helping with everything from key hires to building the next fundraising deck. Of equal importance, we tap into our network to make sure you’re talking to the right people at the right time.Assets under management:

€400MTypical initial ticket size:

€2M to €10MGeography:

Nordics + Northern EuropeStage:

Seed to Series BResource efficiency

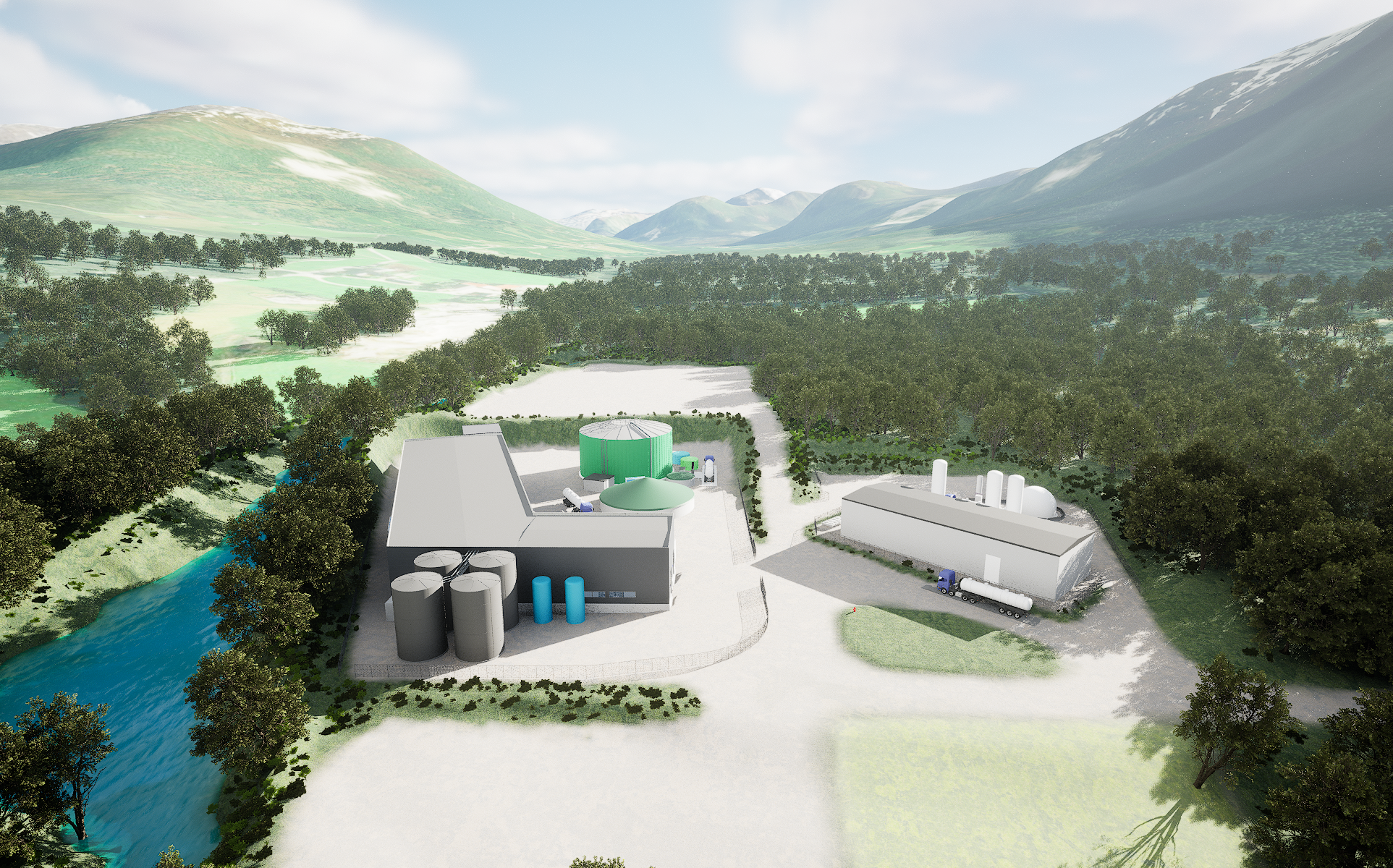

The honest truth is we need to change the way we utilize our resources – reshaping the global economy toward focusing on the sustainable and regenerative as opposed to extractive and single use.These solutions’ business models often include software / hardware combinations where Sandwater has extensive experience. We look for investment opportunities across industries, including sustainable food systems, waste-to-value, resilient ecosystems and manufacturing.

Productivity & Resilience

Technologies that improve productivity, resilience and the health of our societies are key to getting our people, societies and structures in better shape and stay safe in the future.We look for founders building scalable solutions to future-proof societies and industries. We are looking for investment opportunities in productivity optimization, artificial intelligence, robotics, digital health & medical devices and individual & societal security.

Energy transition

Geopolitics continue to drive a paradigm shift amidst the ongoing transition to renewable energy, ripe with investment opportunities to provide more resilient and secure energy systems.The Nordics are at the forefront of the energy transition. The Sandwater team has a strong background from the energy sector and we are passionate about new solutions in low-carbon fuels, next-generation energy production and flexible energy systems.

Ready for investment?

01

What are we looking for?

We look for driven teams solving the world’s most urgent and complex challenges within the key themes we have defined — from advancing robotics and AI, to accelerating the industrialization of the energy transition, making more efficient use of our resources, to redefining access to equitable healthcare. We look for companies with a global potential and ability to grow the tech & commercialize to the full potential. We love deep tech and companies within software, hardware and the right hybrid solutions. Most of all we look for situations where we can really contribute and be part of the journey to the next stage. Supporting them isn’t just our job — it’s what drives us.

02

How much do we invest?

Typically we invest from Seed to Series B with initial investment ranging from €2M and €10M in round sizes that are at least twice our investment and we follow-up with more capital as well. We always look to build great investor consortiums to maximise support, and we lead rounds but don’t have to do so.

03

What support do we offer beyond investing?

The investment decision marks just the beginning of our close partnership - where the real work starts for both founders and investors. We agree early on a gameplan for the next stage, and where Sandwater has the right fuel to support. This could include work on strategy, key hirings, customer introductions, governance, and preparing right for the next fundraise. We offer complementary competence and resources in all key phases of scaling your venture.

04

How do we assess impact in our investments?

Impact assessment is ingrained in the Sandwater investment process. During deal screening we evaluate the company’s fit within our impact thematic framework – including initial hypothesis on theory of change and impact KPIs. During the due diligence process we formalize the impact hypothesis including KPI quantification methodology. When we structure the deal we finalize the impact KPIs and respective targets. When managing the investment we work with companies on both improving positive impact and mitigating the ESG risks.

05

Any investments that we cannot make?

As a Category 8 fund under the EU regulation we also need to maintain an exclusion list ie investments we categorically cannot make. Such exclusions are based either on the particular industries the companies operate under or on their mode of operations. More about ESG at Sandwater can be found at the EU SFDR disclosure section.